The country's largest budget in terms of money

# Income tax limit unchanged

# Govt relies on banking sector to meet budget deficit

# 27 products tax reduced to keep essential markets stable

# GDP growth target set at 6.75 pc

# Corporate tax will be reduced conditionally

# 19 ICT sectors to remain tax-free

# More than 10 lakh people will get allowance

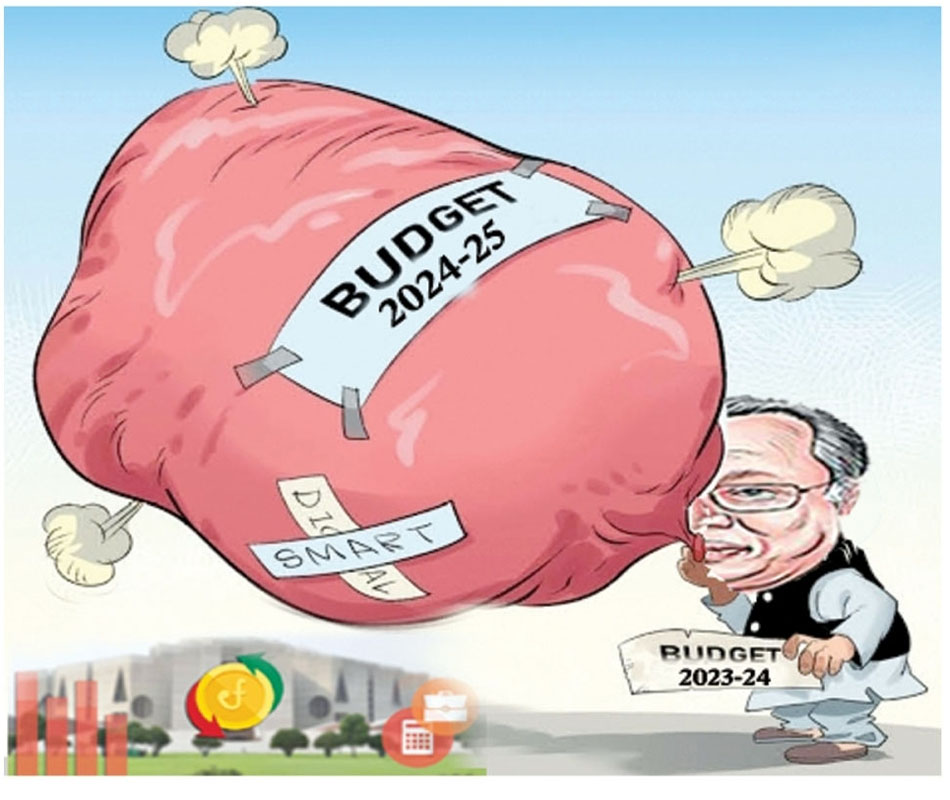

The people of the country have been suffering with high prices of essential commodities for a long time. In order to pacify the common people in such a critical situation of the economy, the budget titled 'Pledge to build a happy, prosperous, developed and smart Bangladesh' has been placed of Tk 7 lakh 97 thousand crore for the fiscal year 2024-2025. This is the biggest budget in the history of the country.

In the proposed budget, the inflation target has been set at 6.5 percent. The same target was set in the budget for the current fiscal year. Later, however, the target was increased to 7.5 percent. It was not possible to achieve the desired goal. Throughout the current fiscal year, the inflation rate was more than 9 percent. In May, inflation was around 10 percent.

The proposed budget is the 25th national budget of the Awami League (AL) government's fourth consecutive term and the country's 53rd national budget. Finance Minister AH Mahmood Ali placed the national budget for 2024-2025 fiscal year in the presence of Prime Minister Sheikh Hasina and Speaker Shirin Sharmin Chaudhury in the chair. The budget will take effect on July 1.

It was known that the budget deficit of this huge amount is estimated to be Tk 2 lakh 51 thousand 600 crore. Without grants, the deficit will be Tk 256,000 crore, which is 4.6 percent of GDP. The government has chosen the banking sector as the main source of income and expenditure to meet the huge deficit of income and expenditure in the budget.

Govt relies on banking sector to meet budget deficit: The government will take a loan of Tk 1,37,500 crore from the banking sector to meet the budget deficit. This figure is Tk 5,105 crore more than the target of the current fiscal year. In the budget of the current fiscal year, the government had set a target to borrow Tk 1,32,395 crore from the banking system. However, in the revised target, it has been increased to Tk 1,55,935 crore.

27 commodities tax reduced to control essential markets: In the budget, tax at source is being reduced on the supply of at least 27 essential commodities and food grains to keep the essential market stable and rein in high inflation. In the proposed budget for the fiscal year 2024-2025, the tax at source on these products has been reduced from 2 percent to 1 percent. The products include onion, garlic, pea, gram, rice, wheat, potato, lentil, edible oil, sugar, ginger, turmeric, dry chilli, pulse, maize, flour, flour, salt, pepper, cardamom, cinnamon, cloves, dates, bay leaves, jute, cotton, yarn and all kinds of fruits.

Income tax limit unchanged in budget: All eyes are on income tax in the proposed budget. Especially for those who are employed, income tax is very important. The annual tax-free income limit of individual taxpayers has not been increased in this year's budget. Finance Minister Abul Hasan Mahmood Ali has proposed to keep the annual tax-free income limit unchanged at Tk 3.5 lakh. Rather, the finance minister has proposed to create a new tax level at the highest level of 30 percent for individual taxpayers. He is also proposing to restructure the tax level by presenting the budget in the National Parliament. Now, after the 5, 10, 15, 20 and 25 percent tax rates, another tax rate has come at the higher level. According to the new proposal, after the first Tk 3.5 lakh, 5 percent tax will be paid for the first Tk 1 lakh, 10 percent for the next Tk 4 lakh, 15 percent for the next Tk 5 lakh, 20 percent for the next Tk 5 lakh and 25 percent for the next Tk 20 lakh.

The rest of the money will be taxed at a new rate of 30 percent. Besides, the tax-free income limit for women taxpayers and those above 65 years of age is Tk 4 lakh. The tax-free income limit for third gender taxpayers and disabled normal individual taxpayers will be Tk 1.75 lakh. The tax-free income limit of the gazetted freedom fighter taxpayer will be Tk 5 lakh. And the tax-free income limit for each child or dependent of a parent or legal guardian of a disabled person will be Tk 50,000 more. When high inflation is going on in the country, there were demands from various quarters to increase the annual tax-free income limit of individual taxpayers. In May, inflation was close to 10 percent. Inflation in the country has been above 9 percent for 15 consecutive months. People on fixed incomes have to spend most of their income to buy food. Food inflation was above 10 percent last month.

GDP growth targets: The government has set a target of 6.75 percent gross domestic product (GDP) growth in the 2024-2025 fiscal year. In the current fiscal year, the rate was initially estimated at 7.5 percent, but later it was reduced to 6.5 percent. The World Bank and the IMF have forecast that GDP growth could be 5.6 percent in the current financial year. The International Monetary Fund (IMF) has projected close to growth. In April, the IMF projected GDP growth at 6.5 per cent in 2023-2024.

Debt repayment expenses will be: In the next fiscal year, Tk 1,13,500 crore will have to be repaid in the interest of various domestic and foreign loans. This interest is 14.24 percent of the total budget. Of these, the interest on domestic loans is high. The amount is Tk 93,000 crore. And the interest on foreign loans is Tk 20,500 crore. In the current 2023-2024 fiscal year, the target of interest expenditure was estimated at around Tk 95,000 crore. But in the revised budget, it was increased to Tk 1,05,300 crore. If the revised budget is based, the allocation of interest expenditure has increased by Tk 7,000 crore. Of this, Tk 1,13,500 crore allocated as interest is 14.24 percent of the total budget.

Corporate tax will be reduced conditionally: The National Board of Revenue (NBR) has decided to reduce corporate tax conditionally. However, not in all sectors, the tax of non-listed industries is being reduced in the capital market involved in the productive sector as before. The tax on such companies is being reduced from 27.5 percent to 25 percent. All other taxes remain unchanged. However, industry stakeholders said that the industrial sector will not be able to enjoy the benefits of reducing corporate tax due to being trapped in the shackles of conditions. The industry needs the benefit of unconditional tax reduction.

Special Benefits for Remittance Warriors: In the budget, the government has allocated Tk 500 crore in favor of Probashi Kallyan Bank to provide loans on easy terms to expatriate workers. From this fund, Tk 293.65 crore has been given to 12,089 borrowers till March 2024.

1 million more people to get allowance: Another 9 lakh 81 thousand 61 people are coming under the social security program of the government. Newly 5 lakh disabled allowance, 1 lakh 50 thousand 480 maternity allowance, 2 lakh elderly allowance, 2 lakh widow and husband desertion allowance, 5 thousand 749 third gender and 90 thousand 832 other backward groups of the society will be brought under the allowance.

Decreasing Construction materials: The duty on import of manganese, raw material for making rods, bars and angles may be reduced from 10 percent to 5 percent. This may reduce the price of ferrous products. Swiss-socket prices may fall. Because the import duty of raw materials used in the production of Swiss-sockets, holders manufactured in the country has been reduced.

Lower dialysis costs: Good news for the health sector is that import duty on filters and circuits used in dialysis for kidney patients has been reduced by 9 percent. This will reduce the cost of dialysis.

19 sectors of ICT remain tax free: In the proposed budget, 19 sectors of information technology (ICT) are exempted from tax. Finance Minister Abul Hasan Mahmood Ali has proposed to keep these sectors tax-free on the condition of making domestic business income and personal business activities cashless in a short period of time.

The sectors are:- AI Based Solution Development, Blockchain Based Solution Development, Robotics Process Outsourcing, Software as a Service, Cyber Security Services, Digital Data Analytics & Data Science, Mobile Application Development Services, Software Development & Customization, Software Test Lab Services, Web Listing, Website Development & Services IT Support & Software Maintenance Services, Geographic Information Services, Digital Animation Development, Digital Graphics Design, Digital Data Entry & Processing, E-Learning Platform & E-Publication, IT Freelancing, Call Center Services, Document Conversion, Imaging and digital archiving.

AL's 53rd budget of 25 countries: Tajuddin Ahmed gave a budget of only Tk 786 crore in a country with a fragile economy after independence. The budget was presented on 30 June 1972. On that day, Tajuddin Ahmad simultaneously announced the budget for 1971-72 and 1972-73 fiscal years, i.e. two fiscal years. After that, Tajuddin Ahmed gave the budget two more times, the last one was 1 thousand 84 crores. Among the 13 members, late Finance Minister Abul Mal Abdul Muhit and M Saifur Rahman gave the budget the most times. Both presented 12 budgets. However, Abul Mal Abdul Muhith presented the budget 10 times in a row for AL. He gave the first budget in 1982-1983, during Ershad's regime. Its size was 4 thousand 738 crores.

ZH

-20250710131233.jpg)