Fuel price and the commodity price are inter-connected. If the fuel price reduces the entire economic sector is affected.

As the Bangladesh Petroleum Corporation (BPC) has gained a lot of profit by selling fuel, there is enough scope to decrease the fuel price now.

The country is now run by an interim government. The Political government has fallen. The interim government has recently assumed power through a mass upsurge in the country following the path of students to build a new society against corruption and irregularities.

The owners and labor leaders, who have been dominating the country's road transport sector for one and a half decades, are now missing. Dozens of top leaders in the sector have been hiding since the fall of the government. In the last 15 years, they have covered up due to uncontrolled extortion and misdeeds in transport. Some of them have become owners of hundreds of crores of taka illegally. They have built mountains of wealth in the country and abroad, including houses, cars.

In continuation of the previous government, the government reduced the price of fuel oil within a month in coordination with the international market. This was expected of ordinary consumers. Production plants or imported goods trucks run on diesel. The price of diesel has been reduced by Tk 6 per liter. In the past, we consumers have seen a consistent trend of fuel price hikes. Transport owners have looted profits by increasing transport fares on the pretext of fuel price hike. It has an impact on the market. As a result, the price of goods has increased. Fuel oil and diesel prices have come down. As a result, the cost of transporting goods has decreased or it is normal.

Supply chain is important in product marketing, specially, in the case of rising commodity prices. Production costs or imported goods prices, transport fare, toll cost of crossing bridges, extortion by administration machinery or political parties were all added to the supply process. As a result, the consumer had to pay a lot of money for goods coming from short distances. But now the context is different. The irregularities of the party government in the interim government are not visible at the moment. However, the impact of the reduction in fuel oil prices in the market has not yet been observed. Prices of essential commodities are still on the rise. The 'syndicate' of the traders was not broken. The government departments engaged in the market monitoring process have been ineffective for a long time.

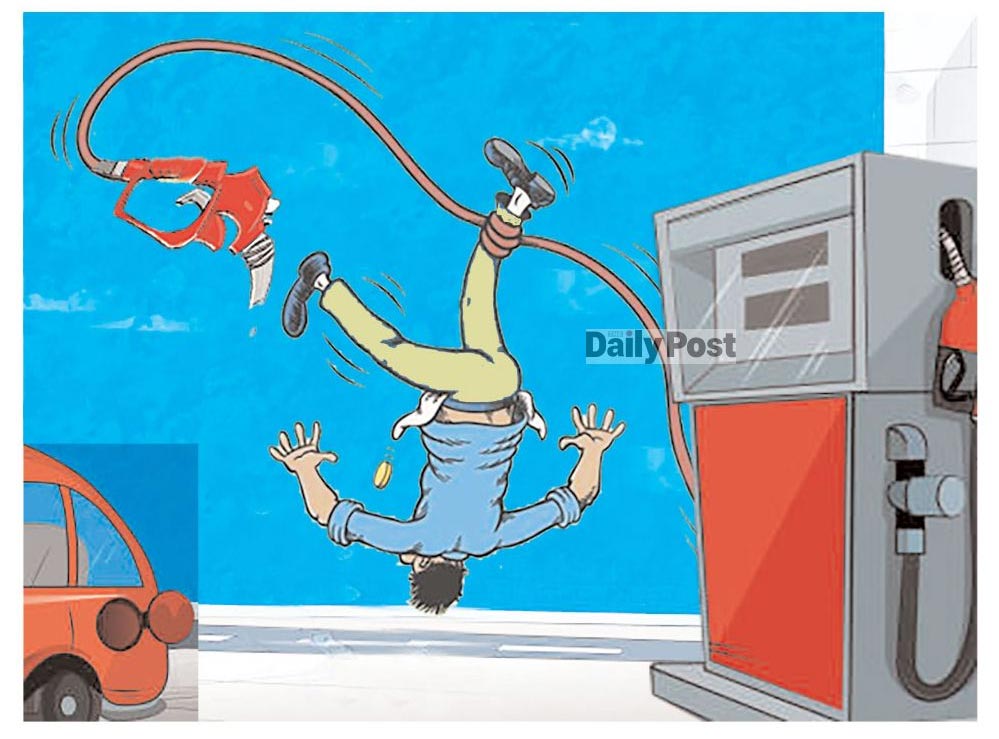

As the price of fuel oil has fallen, its impact on the market of Bangladesh is very low. With the fall in oil prices, the price of commodities could have come down further – the general public thinks so. The impact of the increase in the price of fuel oil in the international market is not seen in the domestic market. Fuel oil is a commodity whose price increases the cost of transportation of goods and passengers. Energy is involved in everything from farming to industrial management. Therefore, with the increase in the price of fuel oil, the prices of all essential commodities in the country's market increase uncontrollably. As a result, an uncomfortable situation is created in the society and the state. The opposite of the reduction in the price of fuel, that is, the decrease in the price of the price does not happen.

Bangladesh Energy Regulatory Commission (BERC) Chairman Jalal Ahmed said the BERC will work on formulating a formula for fixing fuel prices. There should be no complexity in determining the price through BERC. If the government wants to give subsidy in this sector, it can also provide it through BERC. In addition, BERC can verify the annual audit report of each company through a third party. No government company is supposed to make a profit. They will understand the cost.

The BPC Chairman, Amin Ul Ahsan said all the expenses are not under BPC's control. Taxes are in the hands of the government. However, BPC may reduce the import price of fuel oil. It has already started to decrease. If the storage capacity can be increased, the bargaining with the suppliers can be increased. In addition, theft and waste should be reduced to reduce costs. There is no alternative to automatic adjustment of fuel prices in line with the market, the government has started it.

Professor Dr M Shamsul Alam, Energy Adviser of Consumers Association of Bangladesh (CAB) said the energy adviser's decision to keep the government's hand in fixing the price of fuel oil without giving it to BERC has disappointed. It should be handed over to BERC by issuing rules quickly. Otherwise, like LPG, it will also be forced through the court. The government takes revenue of Tk 13,000-14,000 crore every year from fuel oil, BPC also makes profit. This is a contradiction of the government.

CPD Research Director, Khandaker Golam Moazzem said it is possible to reduce the price of fuel by assuming BPC's 5 percent profit per liter. And if the formula for fixing the price through BERC is made, the price will come down further.

Organization of the Petroleum Exporting Countries (OPEC) fears that oil demand may fall further in 2024-25. According to OPEC data, the daily demand is now 1.78 million barrels, but the demand may fall to 1.74 million barrels.

For more than a year, OPEC has not been able to increase the price in the market even after reducing oil production. OPEC and allied countries decided to increase crude oil production in October and November. But as oil prices fell below $70, they decided to postpone the deadline for an increase in extraction by two months.

Ben Luckcock, head of oil at Trafigura, a multinational company at the Asia-Pacific Petroleum Conference (APPEC), said the oil market was worried about falling demand in China, the world's second-largest economy. Soon the price of crude oil in the world market may fall to $60 per barrel.

ZH