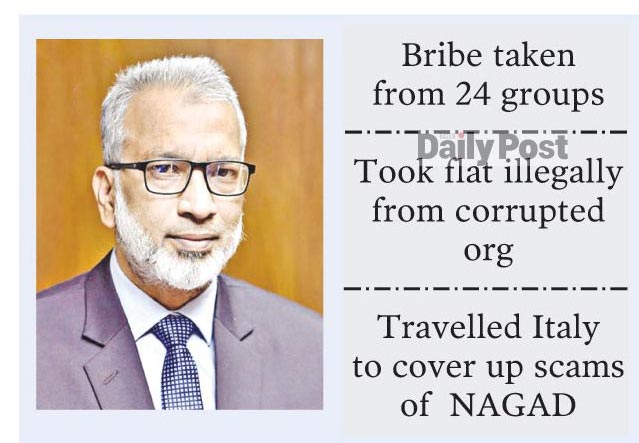

- Bribe taken from 24 groups

-Took flat illegally from corrupted org

-Travelled Italy to cover up scams of Market Systems and NAGAD

The former head of Bangladesh Financial Intelligence Unit (BFIU) Masud Bishas remained silent intentionally after the scandal of Tk 92 thousand crores through bribery and corruption. It is known that the resigned BFIU chief has paved the way for looting banks and financial institutions by taking huge financial benefits from 24 different groups including Bismillah, Hallmark, Thamax Group, Nabil Group, and S Alam Group.

Allegedly, the Cash Transaction Report (CTR) was not verified by the BFIU, behind which Masud Biswas was the secret power. He remained silent even though more than Tk 92 thousand crore of scams occurred in front of his eyes in about half a hundred cases. Although Masud continued such irregularities for a long time, no one took action against him due to the high echelons of the government. The Anti-Corruption Commission (ACC) has entered the field to investigate the irregularities of BFIU chief Masud Biswas.

A decision was taken in this regard from the head office of the ACC yesterday. After getting the preliminary facts in the investigation of the intelligence unit of the ACC, it was decided to open the investigation against him.

According to ACC sources, Bangladesh Financial Intelligence Unit (BFIU) is responsible for preventing money laundering. But he could not stop it; on the contrary, the recently resigned from the head of BFIU, Masud Biswas, has been accused of taking bribes in various ways along with assisting in money laundering.

Masud Biswas is also accused of wasting money by pressurizing the banks through training programs, organizing various unnecessary events and foreign trips. In the past few years, BFIU conducted 8-10 major investigations per year just as formality and took financial advantage from many organizations.

According to the complaint, BFIU chief Masud Biswas did not take any measures to prevent the money laundering despite being informed about money laundering abroad by taking unethical benefits from a Chittagong-based business group and Abdul Qadir Mollah's Thermex Group. Even in the case of smuggling of Zeenat Enterprise, he covered it up in exchange of a bribe of Tk 50 lakh. Besides, BFIU did not take any action in this regard even though serious irregularities were detected in the transfer of loan money granted in favor of various organizations of Thermex Group through various branches of UCB Bank to the interests of the chairman of the bank to some related organizations. Besides, Masud Biswas illegally took a flat of 2000 square feet as bribe from a private bank while being an observer.

It is said in the complaint that the concerned bank has given a financial benefit of Tk 400 crore by exceeding the single customer credit limit in favor of Rupali Bank's customer Dolly Construction. Although the matter was caught in the investigation of BFIU, Masud Biswas did not take proper action by accepting bribe. Apart from this, about Tk 1500 crore were distributed from the four branches of the bank in favor of some institutions including National Bank's customer Santana Enterprises without the approval of the head office.

Masud Biswas arranged to exonerate the concerned officials of the bank by taking illegal benefits from the branch managers. Apart from this, the negligence, corruption and irregularities of various banks were revealed during the verification of irregularities in loans of about Tk 1000 crore from several banks of Saad-Musa Group, but he did not take any action by taking illegal benefits through official power.

The complaint further states that against the Chua debit instructions of BRAC Bank customer Sajida Foundation, in 2021 $82,416 was transferred to ING Bank customer FMO NV INL MASSIF. Masud Biswas covered up the irregularity in return for receiving illegal benefits from the bank. Apart from this, Masud Biswas exerted illegal influence for approval of sending a remittance of $100 million in favor of Shireen Spinning Mills, a customer of Jamuna Bank's Dhanmondi branch, and providing a bank guarantee of Tk 1000 crore in the name of Tiger IT, a customer of NRBC Bank, a blacklisted company of the World Bank. He also took money from corrupted institutions and travelled to Italy to cover up financial scams in Market Systems and NAGAD.

ZH