Due to high inflation, unrest in commodity market, people spends their savings from the banks in the rural areas. As a result, deposits of the rural area declined by more than a quarter. According to Bangladesh Bank (BB), the deposits in rural banks decreased by about 27.56 percent in the last quarter compared to the previous quarter (April-June).

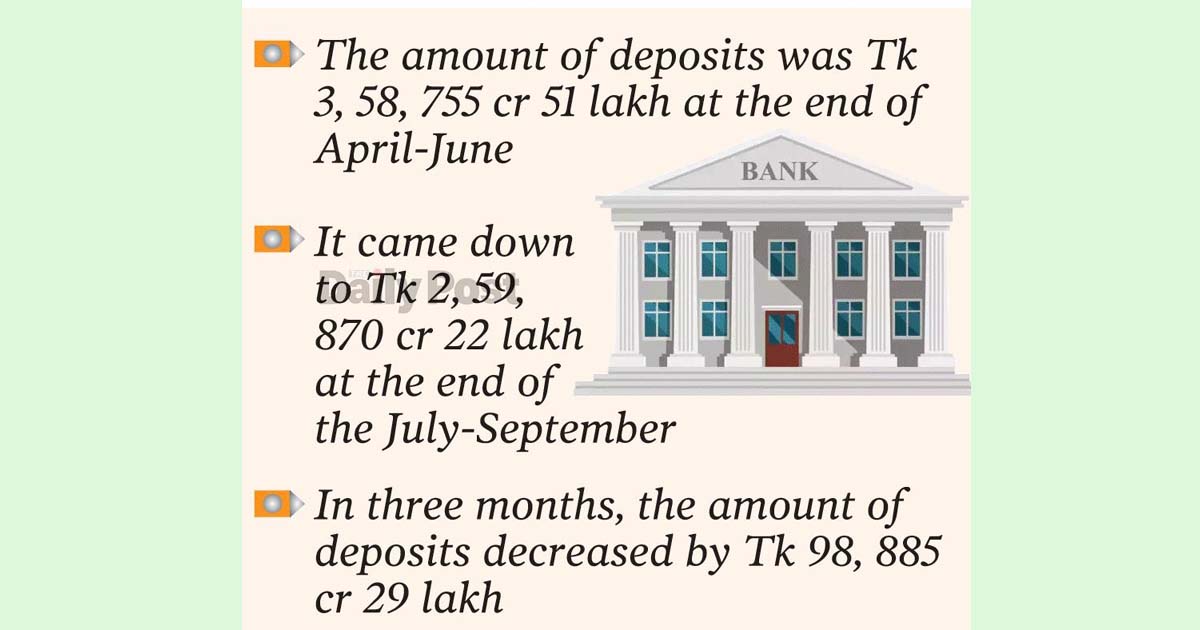

At the end of April-June quarter, the amount of deposits deposited in the branches of scheduled banks in the village was Tk 3 lakh 58 thousand 755 crore 51 lakh. At the end of the July-September quarter, it came down to Tk 2,59,870.22 crore. Accordingly, the amount of deposits deposited in rural banks has decreased by Tk 98,885 crore 29 lakh in three months.

The fact that bank deposits in rural areas has fallen by around Tk 1 lakh crore in just three months is now worrying economists and bankers. They said the matter needs to be investigated. The main destination of remittances collected in the country is the rural areas. A large part of this remittance is deposited in the bank as a deposit. And BB data shows that in the July-September quarter, along with remittances, deposits in rural banks have decreased drastically.

According to the central bank, in the July-September quarter of 2023, remittances through banking channels in the country reached 490 crore 69 lakh dollars. In the same period of 2022, the amount was 567 crore 28 lakh dollars. As a result, remittance flow has decreased by more than 13.5 percent in the last quarter.

Executive Director of Policy Research Institute (PRI) Dr Ahsan H Mansur said that the economy in rural areas is better than in urban areas. The reason for the decrease in deposits there is not clear. Deposits may fall slightly due to inflation, but it is not supposed to be so low.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said that the growth of deposits in the country's banking sector has been slow for almost two years. Due to this, a liquidity crisis has also been created in the country's banking sector. Some banks are now announcing to collect deposits at 12 to 13 percent interest. Even after this, the expected deposit does not match. Due to high inflation, the cost of living of the people has increased a lot. Because of this, most people do not have money left in the hands of savings in the bank. Again, there is a kind of panic in the minds of the common people centering the national election. If the political situation calms down after the election, the growth of bank deposits may return.

According to sources, the large parts of the depositors of the marginalized people of the country have savings deposited in Shariah-based banks including Islami Bank Bangladesh. For more than a year, there has been negative publicity about the activities of most banks of this genre. As a result, the flow of deposits of Shariah-based banks has decreased. Especially in the rural branches of this type of bank, the trend of withdrawing deposits has increased a lot.

A top executive of a Shariah-compliant bank, on condition of anonymity, said, "Many customers are withdrawing deposits from bank branches. Negative publicity has created panic in the minds of the people. Especially the people of the village are more influenced and frightened by such campaigns. For this reason, withdrawal of deposits in our rural branches cannot be stopped."

In addition to Shariah-based banks, deposits from rural branches of state-owned banks are also declining, according to the central bank report. However, the growth trend in the total deposits deposited in the country's bank sector continued at this time. In the April-June quarter of the current year, the total deposits in scheduled banks of the country were Tk 16,87,24.61 crore. At the end of the July-September quarter, it increased by 1.55 percent to Tk 17,13,134.86 crore.

Managers of local branches of different banks also said that the people of the village are breaking savings to meet the cost of living. Rabiul Islam, Manager of The City Bank Limited's Jashore Branch, said that people are breaking their savings mainly due to the high standard of living. Due to the high prices of all things in the market, the middle class and lower middle class are not able to keep pace with the income. That's why they're breaking the DPS. Our deposits are also decreasing.

Since the beginning of 2023, the inflation rate in the country has been close to 10 percent. In September, the overall inflation was 9.63 percent, but it was more than 12 percent in food. At that time, the rate of food inflation in the village was also higher than in the city.

Former governor of BB Salehuddin Ahmed said that the cost of other ancillary services has increased along with the price of commodities. From gas to agricultural inputs, the prices of livestock, poultry and fish feed have increased. Overall, the cost of living, agriculture and everything else has increased. People have to put their hands on savings. Again, a kind of apprehension has worked among many ahead of the upcoming election. Many may be holding money for emergency expenses.

According to the central bank, the highest divisional deposit has decreased by up to 45 percent in the rural areas of Dhaka. In the second position, deposits in rural areas of Chittagong decreased by 19 percent. Sylhet division's deposit decreased by 11 percent. And in Rajshahi and Barisal, the rate is more than 8.5 percent. In Mymensingh division, the rate is 2 percent.

ARS