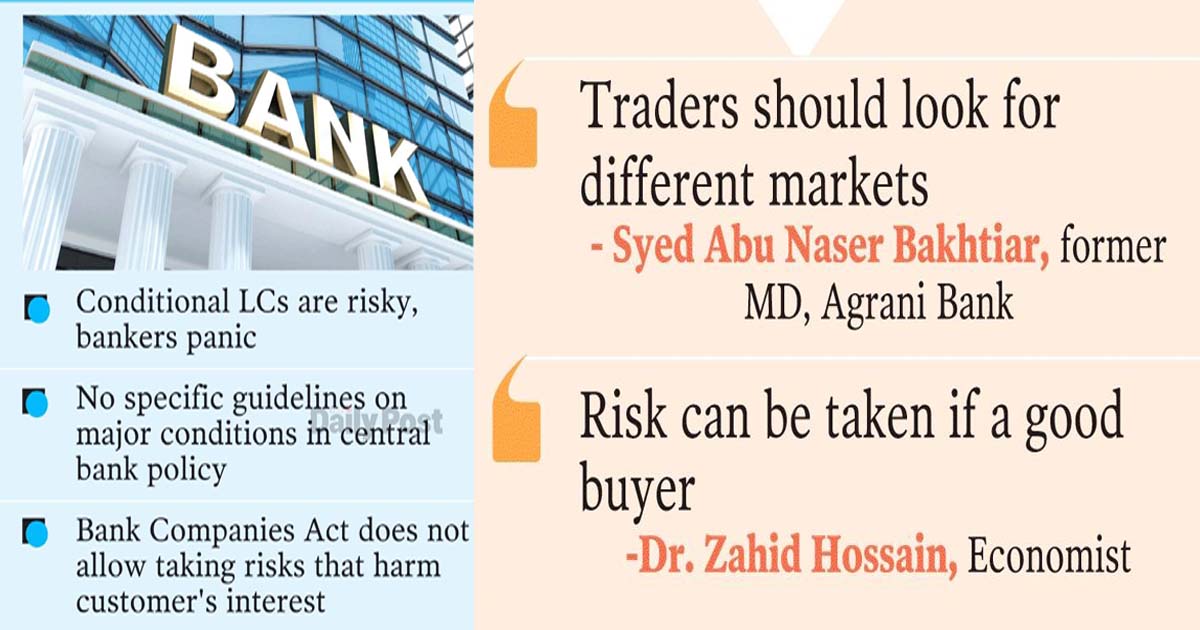

Banks are worried about sanctioned-related LCs. Opening of Conditional LC is risky on the one hand, on the other hand, there is pressure on bankers from business interests and owners. There is a lot of tension in the banking sector. However, bank MDs are reluctant to comment on this matter. However former bankers feel that since the issue of sanction is a big condition, LC should not be accepted if there is such a condition. Somewhat balanced like economists. They say risks must be taken by reviewing conditions and taking into account buyer behavior to sustain business. There are no specific instructions in this regard in the policy of the central bank. All in all, the bank officials are in a confusion about the matter. Farooq Hasan, president of BGMEA, an association of garment exporters, said in a meeting with stakeholders recently that various pressures are coming from the United States and Europe, the main buyers of the country's garment sector. He said, "There is an issue from the US. You have seen that the president has signed a memorandum. European Union has also visited our country.

That is also the pressure." The buyers have already given a clause that if sanctioned, they will not take the goods, let alone the payment, even if the goods are given, they will not pay. Our bank will not open LC in this clause.

It is known that the buyer has given a credit letter for ready-made clothes with the condition of not taking the product or paying the money if it faces any sanctions.

After this, the uproar started over the issue. Confirming the matter to the media, Farooq Hasan said, for the first time, a buyer company has said in the general terms of the loan that they will not take the product if Bangladesh faces any sanctions. If there is any incident of embargo after the shipment of the goods, then the buyer company will not pay. What will the banks do in such a situation? Bank officials are in doubt whether to accept the conditional LC. There is no specific explanation in this regard in the instructions of the central bank. However, there is no opportunity to open this type of LC as per the conditions given in the Bank Companies Act to protect the interests of customers. Considering the overall situation, former managing director of private mutual trust bank Anis A Khan has given an opinion in favor of not accepting LC if there are conditions of sanction. No bank should open an LC subject to sanctions, he said. Former MD of Agrani Bank and prominent banker Syed Abu Naser Bakhtiar Ahmed also thinks that under such conditions the bank should not accept LC under any circumstances. He said, "There is no opportunity to give such conditions in international trade. If someone gives such conditions then traders should look for other buyers. The bank is not allowed to get involved in any business that may have risks in the future. However, Dr. Zahid Hossain, the former chief economist of the World Bank's Dhaka office, thinks that for the sake of sustaining the business, it is necessary to take risks if there is a good buyer. Because if the order is canceled it will be difficult to sustain the business. He said, "We can request to remove the conditions first. If that is not possible then the previous behavior of the buyer should be brought under review. Risks can be taken if opportunities are not sought. Otherwise, the business will suffer. "If I were a banker, I would take risks if I was a good buyer." Bangladesh Bank does not want to take any position on this matter now. No one has yet asked the regulatory body what to do in such a situation. As it is not yet clear when or if the sanctions will come or whether the conditional LCs have started coming; Therefore, the regulatory body thinks that the business should continue in the light of the previous policy. When asked about this, the Executive Director and Spokesperson of the Central Bank, Majbaul Haque, said, "In fact, the banks will follow the circular issued by the Foreign Exchange Policy Department (FEPD) of the Bangladesh Bank for LCs with sanction conditions.

Officials of the relevant departments of the Central Bank say that the existing circular is not specific about such major conditions.

The conditions contained in the current directives are for a step-by-step settlement of issues relating to the coordination of multiple aspects of foreign trade. However, concerning external conditions, section 123 of the Bank Companies Act relating to the protection of the customer's interest has been asked to be followed. Those concerned say that if this clause is followed, there is no opportunity to accept the LC with the condition of sanction. Incidentally, the threat of sanctions or sanctions is leading the troubled economy of the country to a deep crisis. The impact has already begun as trade sanctions from the United States and its allies are threatened. As a result there is apprehension and frustration in the export sector.

Businessmen had been quietly observing for so long, considering creating political influence. Now they have started to express their fears. BGMEA President Farooq Hasan told the media that the main export sector has started to suffer. As a result, the crisis is intensifying before the sanctions. Meanwhile, there is instability in foreign trade due to decline in exports and remittances. Foreign exchange reserves continue to erode.

Dollar sales from reserves continue to import essential goods. Donor groups, including the IMF, may also stop disbursements due to political instability. Therefore, if there is no political agreement, economists believe that the sanctions will put the country's economy in a fragile situation.

Trade restrictions, they say, are a pernicious process that can destabilize a country in an instant. This is more of a problem in import-dependent countries like Bangladesh. Because if exports fail to earn foreign exchange, imports will stop. Bangladesh has to import products like electricity, gas and fuel oil. Many necessary products including baby food are being imported. Dr. Wahiduddin Mahmud, former caretaker government advisor and former professor of Economics Department of Dhaka University, said, "Sanctions on individuals or organizations are their business. Nothing comes or goes in it. But trade sanctions are a very big issue for Bangladesh. If there are new restrictions on this, there will be a big shock to the economy.

Threats to impose trade embargoes on various pretexts such as fragile labor environment and oppression are political, but the issue is political. As a result of the uncertainty surrounding the national elections of Bangladesh, foreign powers have joined it.

The government is moving towards a one-sided election with the help of anti-Western countries. On the other hand, Europe and America have taken a position in favor of holding elections through compromise, demanding the continuation of the democratic process.

Before the schedule of the 12th national elections to be held on January 7, United States wrote to the political parties calling for dialogue, but the ruling party rejected the poison. After that, threats of bans started coming one after the other. The US has already imposed a ban on seafood and products made from it. Earlier, the United States announced a new policy to protect labor rights around the world on November 16. While officially announcing this policy, the country's foreign minister, Antony Blinken, said that sanctions will be imposed on those who will go against the rights of workers, and threaten and intimidate workers, if necessary. The Bangladesh topic was dragged into it. As a result, it can be used for political purposes - the message comes from the Bangladesh Embassy in Washington. On November 20, a letter was sent to the Commerce Secretary expressing "concern" about the US policy. It is said in that letter that Bangladesh can be the target of this new policy on labor rights. Because, if labor rights are violated, there is an opportunity to impose this policy on individuals, institutions, or the state.

The European Union has already completed all preparations to take similar steps. Therefore, Center for Policy Dialogue - CPD Honorary Fellow Dr. Debapriya Bhattacharya said, 'Elections for wish fulfillment will not give good results'. Currently, the country is facing three crises – political, economic, and foreign relations crisis. This crisis is intensifying. If the election is not fair, the United States can take various steps as mandated by its existing laws. There is a risk of trade sanctions. The issue of Kalpana Akter has already come to the fore. We have to remember that this is not a fantasy, it is a real 'fantasy'. Regarding the deterioration of foreign relations, he said, the words used from the highest places of the government create discomfort in diplomatic relations.

ARS