An obscure company named Nabil Group took loans of Tk 6,370 crore from three Islamic Shariah-based banks without sufficient collateral. This huge loan amount was approved in just six months. The three banks approved loans to various companies in the name of the group without regard to the law.

Although these institutions do not have the ability to spend such a huge amount of money. Even the loan documents have been made to disappear.The concerned officials say that an influential gang has arranged loans through cheating for the very purpose of looting. Bangladesh Bank`s initial inspection revealed such a picture.

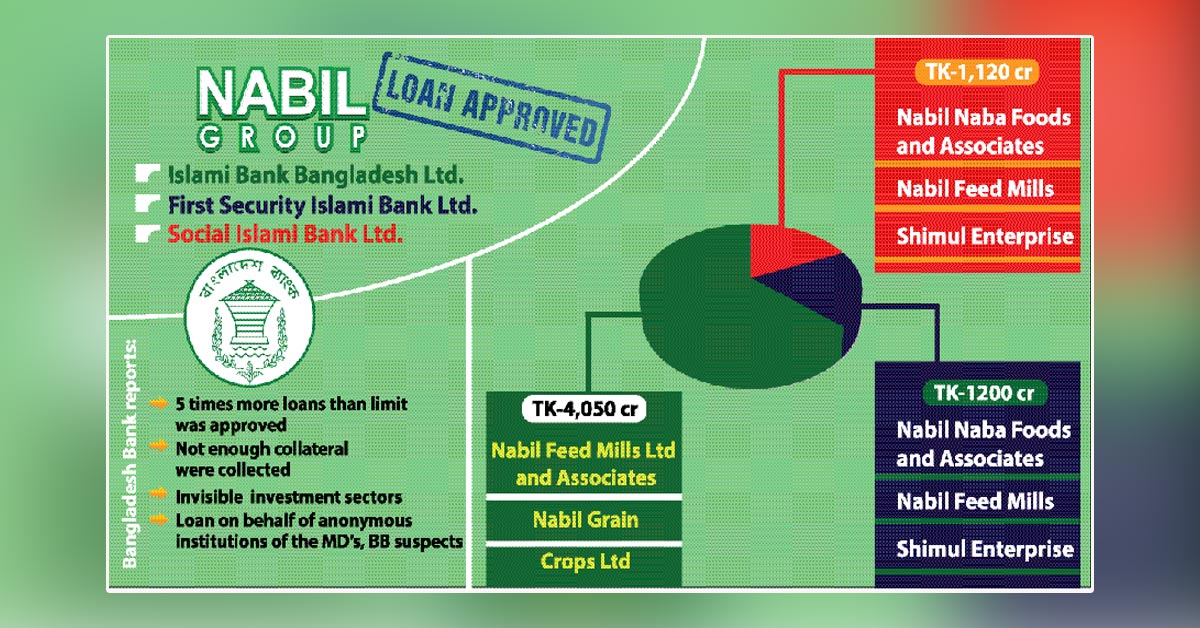

It has been recommended that the matter be sent to the Special Inspection Department of the Central Bank for further investigation.According to the information revealed by the central bank inspection, Islami Bank Bangladesh Limited has given a loan of Tk 4,500 crore, First Security Islami Bank Tk 1,200 crore and Social Islami Bank Tk 1,120 crore to this obscure group. In most cases, no collateral is kept for sanctioning these loans. Apart from this, it is not clear where the loan money will be used.

A review of the data shows that a loan of Tk 950 crore has been given to a company of the group. But according to the latest CIB (Credit Information Bureau) report, before that the company has had loans of only eight and a half lakhs in various banks and financial institutions. That is, the loan has been approved without verifying the ability to use the money.

On the other hand, the loan limit (single party exposure limit) contained in the Bank Companies Act has been violated in sanctioning loans in the name of multiple institutions of the same group. The inspection team of the central bank has submitted a report suspecting these loans as anonymous loans in the name of the bank`s managers. Necessary documents have been sought from the banks for further examination.

The Daily Post tried to contact Nabil Group, Islami Bank Bangladesh Limited, First Security Islami Bank and Social Islami Bank to get their statements on these issues. But even after calling on phone repeatedly and texting on whatsapp, the Managing Director of Nabil Group, Aminul Islam could not be reached, making his statement unavailable.

Social Islami Bank Managing Director Zafar Alam was called on his personal mobile phone. The MD`s assistant informed about the busyness after receiving the call. He did not respond to questions later sent via text message either. Monirul Mawla, Managing Director of Islami Bank Bangladesh Limited, was contacted several times by phone and text messages but his statement was not received.

Syed Wasek, managing director of First Security Islami Bank, did not receive the call.

According to the report of Bangladesh Bank, the total approved loan or investment of three banks is 6 thousand 370 crores. Among these, a loan or investment of Tk 3,100 crore in favor of Nabil Feed Mills and its affiliates in the Rajshahi branch of Islami Bank was approved in the 308th board meeting of the bank on March 21 this year. A loan of Tk 950 crore was approved in the name of Nabil Grain Crops at the bank`s Gulshan branch. Apart from this, in the 246th board meeting of First Security Islami Bank on June 23 this year, a loan of Tk 1,200 crore was given in the name of Nabil Naba Food and its subsidiaries, Nabil Feed Mills and Shimul Enterprises. In the 481st board meeting of Social Islami Bank on May 30 of the same year, a loan of Tk 1,120 crore was approved in the name of Nabil Nabil Food and its subsidiary Nabil Feed Mills and Shimul Enterprises from Gulshan branch. In total, the loan amount of this unknown group to the three banks is 6 thousand 370 crores.

According to the report, a loan of 1,120 crores was given in the name of Nabil Feed and Shimul Enterprise, a subsidiary of Nabil Foods, a customer of Social Islami Bank`s Gulshan branch. Out of this funded (cash) 450 crores and non funded (LC and bank guarantee) 670 crores. In this case the investment limit has been newly approved. But it is not mentioned in which sector this money will be used.

So a new customer is recommended to verify the huge loan approval. Banks have been asked to know certain things. In this forced (compulsory) loan recovery progress should be notified, the consideration of which this loan has been given should be explained. Apart from this, the necessary documents related to loan approval have been asked to be submitted.

The report also mentions that no security has been taken against such a huge loan. LC commission was only 15 percent in three months. Corporate guarantee of Nabil Firm has been accepted in respect of guarantee. Apart from this, although the loan was approved in the 481st board meeting of the bank, the loan conditions were relaxed in the 482nd and 483rd board meetings. In this case all directors and their spouses gave guarantees in respect of personal guarantees at the time of approval. But later the conditions were relaxed and only the directors provided guarantee.

In the case of saving of deposits, it was said that - in the name of one`s own name or in the name of others on reference, the deposit should be increased to Tk. 200 crore initially and later on to Tk. 600 crore. But later it was relaxed and said that adequate deposits should be kept. This adequate deposit is also not explained. The inspection team opined that it is important to know on what grounds the condition is relaxed in the case of a new loan. Also, the customer has been asked to verify whether there is any organization related to the interest of the board of directors of the bank anonymously.

According to the report of Bangladesh Bank, the new customer of Islami Bank`s Gulshan branch, Nabil Grain Crops, is supposed to have Tk 230 crore as collateral in the case of non-funded loan of Tk 950 crore. The terms of the loan include a deposit or lien of Tk 110 crore. In one place it is said that this money will be used for import and marketing of agricultural products. But according to the latest CIB report, the total exposure of customers in various banks and financial institutions is only eight and a half lakh taka.

After reviewing the project loan, the customer is brand new. As a result, a completely new customer is given this amount of credit for trading. In this case, it is necessary to verify whether the customer`s big business management skills and money have been used properly. In addition, Islami Bank Rajshahi branch has approved a total of Tk 3,100 crore including Tk 700 crore in the name of Nabil Feed Mills. But Nabil Grain Crops is mentioned as not belonging to any group. But the inspectors of Bangladesh Bank have doubts - this is also a group institution. As a result, the law regarding lending to a single group has been violated in this case.

Those concerned say that a bank can lend up to 35 percent of its paid-up capital to a single institution, both funded and non-funded. Out of this, 15 percent is funded and 20 percent is non-funded. And at present the total paid up capital of these three banks is 3 thousand 690 crores. In this case, the group has the opportunity to lend up to 1,300 crore Taka. But loans have been given almost five times more.

According to Nabil Group website, the group has 17 companies. These are Nabil Naba Food, Flower Mill, Feed-mill, Auto-Rice mill, Dal Mill, Consumer Products, Nabil Farm, Cattle Farm and Nabil Transport. But only six products are mentioned in product options on this web site. These include - rice, flour, atta, semolina, pulses and fodder. Md. Jahan Box Mandal is the chairman of the company. Director Israt Jahan, Managing Director Aminul Islam and Deputy Director Md. Mamunur Rashid.