People are waiting for the reform in mobile call rate and internet cost as it is too much day by day. However, no initiatives are seen by the Bangladesh Telecommunication Regulatory Commission (BTRC) or The Ministry of Posts, Telecommunications and Information Technology.

Nowadays internet has become an essential part of daily life. From social media to education, shopping, office work, internet usage has increased in all areas. However, in the progress of Smart Bangladesh, 40 to 45 percent of the country's population is still out of telecom service. Compared to our neighboring countries, we are several times behind in the use of data at the customer level. However, there is a huge scope for revenue growth along with customer growth in this sector.

The tax rate on mobile phone services in Bangladesh is high. If the mobile operators earn Tk 100 from the customers, Tk 54 is received by the government for various taxes and fees.

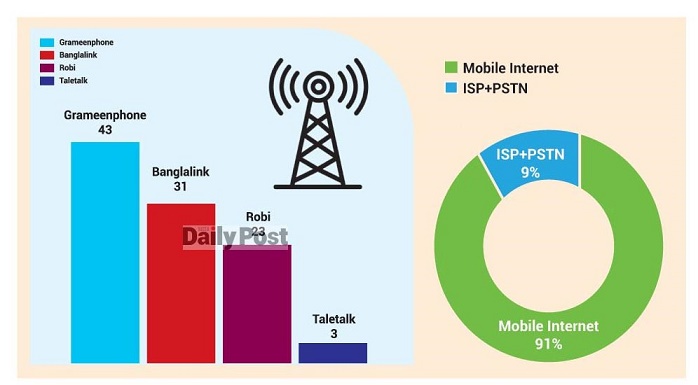

Association of Mobile Telecom Operators of Bangladesh (AMTOB) Secretary General Lt Col Mohammad Zulfikar (Retd) said that there are more than 19 crore mobile phone subscribers in the country. More than 11 crore mobile internet subscribers are in the country. They use an average of 6 and a half gigabit (GB) of data per month.

Mohammad Zulfikar said that the tax rate imposed on the telecommunication sector is very high. If taxes and fees were not high, the use of telecommunication services would have increased. It played a major role in increasing the country's gross domestic product.

National Board of Revenue (NBR) collects Tk 39 for every Tk 100 income of operators. BTRC charges Tk 15 for various fees including license, wave. Tk 18 is received by various private service providers, including tower companies, which provide services in the telecommunication sector. Operator can keep Tk 26 only.

The rate at which the government collects money from the telecommunication sector in terms of taxes and fees is much higher than that of other countries in the world. The global average rate in this regard is 22 percent. In Bangladesh which is more than double.

Be it profit or loss, operators have to pay 2 percent transaction tax on their gross income. For tobacco companies, the rate is 3 percent. Tobacco trade is injurious to health. Imposing high transaction tax on mobile operators like them is unreasonable.

Bangladesh has the highest corporate tax rate in the telecom sector, highlighting the corporate tax rates of 11 countries—Singapore, Thailand, Cambodia, Indonesia, Malaysia, the Philippines, Sri Lanka, Pakistan, Nepal, India and Bangladesh. In case of listed telecommunications companies in Bangladesh capital market, the rate is 40 percent. Otherwise the rate is 45 percent for the others.

In the financial year 2017-18, if the customer recharged the mobile phone by 100 taka, tax of Tk 21.75 could be deducted from it. Now it goes for a little more than Tk 33.

According to the data of Bangladesh Telecommunication Regulatory Commission (BTRC), more than 12 crore subscribers out of 19 crore 22 lakh SIM card holders in the country have used the internet.

Currently, a mobile internet customer in Bangladesh uses an average of 6 and a half GB of data per month. Where as in neighboring country India, customers use 27-29 GB per month. Consumers in Bangladesh are several times behind in data usage compared to India.

A review of consumer level mobile internet service tax in different countries of the world shows that in Malaysia 6%, Thailand 7%, Nigeria 7.5%, Singapore 9%, Indonesia 11%, Philippines 12%, Cambodia 13%, India 18%, Sri Lanka 23%. .5%, Nepal is taxed at 26.2%, Bangladesh at 33.25% and Pakistan at 34.5%.

In the progress of Smart Bangladesh, 42 percent of the country's population is still out of telecom service. 63% of current mobile service users use mobile internet and 54% are 4G subscribers. That is, a significant part of the current mobile service users are still unable to use mobile internet services (37%) and have not yet acquired the ability to use 4G services (46%).

The Daily Post reporter tried to reach the Advisor's phone and sent him a message about this, but he did not respond.

ZH